CGAAF benefits

We believe CGAAF is a unique global financial solution like no other. The development process was guided by industry experts and active traders, thus creating a solution that caters to investors of diverse backgrounds and needs.

Administration and support

World Class administration and support team – established Fund Administrators, MAS-regulated Trustee and internationally renowned legal advisors

Denomination

CGAAF can be denominated in a wide range of currencies – E.g. USD, EUR, GBP & SGD

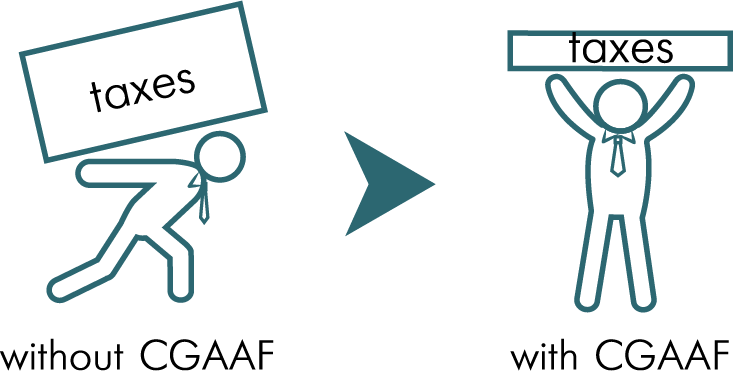

Taxes & Feeds

Tax efficient structure

Fund size

No maximum limit on fund-size

Open architecture

CGAAF can accept and transact in a wide range of asset classes including equities, fixed income, mutual funds, alternative investments & other illiquid assets

Inheritance planning

Ease of ownership transfer facilitating estate planning – units of CGAAF can be transferred easily to your next generation, making the inheritance planning process smooth

Confidentiality

Confidentiality of asset-ownership

Autonomy

The investor has a say in his investment decisions.

Flexibility

The investor may redeem his investment, in part or in full, at any time.

Possible Perpetual term

CGAAF can transcend generations

Consolidation of assets

Investor can consolidate all assets in CGAAF in order to simplify management process and maximize efficiency

Provisions for Leveraging

CGAAF units can be collateralized for loans to the investor

Trading platform

Proprietary trading platform – Castle Trader, powered by Interactive Brokers

Convenient structure for management

Structure that resembles a Single-Family Office – CGAAF gives the investor the ability to manage diverse assets under the umbrella

Minimum investment amount

Low minimum entry size

Co-operation

No conflict of interest between investor’s existing custodian banks and CGAAF

Trustee Domicile

Trustee is registered in one of the most well-regulated financial jurisdiction